Strategizing CPG distribution channels: Adapting to the new retail reality

In the consumer-packaged goods (CPG) industry, getting your products from the factory into the consumer’s hands is crucial. To ensure that products reach the point of sale effectively—be it a physical storefront or an online marketplace—CPG companies can follow two primary channel strategies: partnering with a distributor or selling directly to retailers, known as indirect and direct distribution channels, respectively.

But when is it advantageous to engage directly with retailers? What circumstances call for the support of a distributor? And what are the key distinctions between direct and indirect sales from the standpoint of a CPG company?

In optimizing route-to-market strategies, the rise of centralized purchasing organizations within retail groups is also a trend to reckon with. These entities, which manage procurement for multiple store brands, can represent either direct or indirect sales channels. There can be great variance in their impact depending on their involvement in negotiations and volume management.

In this blog post, we’ll explore the nuances of CPG distribution channels. We’ll examine the benefits and drawbacks of each method. And we’ll discuss the importance of data and technology in optimizing your route-to-market strategy.

So, let’s dive right in…

Understanding product distribution channels in CPG

Understanding product distribution is pivotal in the CPG industry, as it ensures that your products are accessible to consumers through various distribution channels. These can be relatively simple to increasingly complex. CPG distribution encompasses not just the logistics of transportation, packaging, and delivery, but also the strategic placement of products. A robust distribution strategy is about precision: delivering the right SKU, at the right price, to the right place, and at the right time. This precision helps avoid overstocking and out-of-stock events, ensuring optimal shelf performance. Moreover, distribution is intrinsically linked to trade spend and promotion activities. When synchronized effectively, they can significantly enhance product visibility and sales performance.

CPG companies often adopt an intensive distribution strategy. Such an approach aims to saturate the market by placing products in as many outlets as possible. It maximizes reach and, consequently, sales volume. A classic example is Coca-Cola’s intensive distribution, which places their products in a diverse array of venues, from supermarkets and burger restaurants to vending machines and online quick commerce platforms, ensuring convenience and strong brand visibility.

Crafting a future-proof route-to-market strategy

The significance of a solid distribution strategy cannot be overstated. It is a cornerstone of CPG success, directly influencing shopping behavior, brand recognition, and sales. The retail landscape is undergoing a significant transformation, driven by the convergence of physical and digital shopping experiences. The global omnichannel retail solutions market is a testament to this evolution, with projections indicating a compound annual growth rate (CAGR) of 13.6% to reach $17.92 billion in revenue by 2030 (source: Grand View Research).

In this rapidly changing environment, CPG companies must remain vigilant and adapt their route-to-market strategies to preserve a competitive edge. Currently, the vast majority of CPG products are sold through traditional retail stores. However, there’s a growing shift towards direct-to-consumer (D2C) and online marketplace channels. Although D2C is on the rise, it only still represents a small part of the total CPG sales volume, primarily aiding the growth of early-stage and emerging brands. These brands are increasingly recognizing the importance of integrating physical retail into their distribution strategies to further scale their operations.

Read more about revenue management trends in the CPG industry: CPG trends insight: Top 5 game changers for revenue growth management in 2025

Direct retailers in CPG

Direct sales in the consumer-packaged goods (CPG) sector usually refers to the process of selling products straight to retailers. For CPG companies, the primary focus is on two key stakeholders: the end consumers and the retail partners. Securing retail alliances is as pivotal as consumer engagement, considering the substantial volume of sales they represent.

Pros and cons of direct retailer sales

Pros:

- Direct relationships: Setting up direct relationships with retailers opens many opportunities for collaboration. These include power partnerships, targeted segmentation, mutually beneficial trade promotions, and the sharing of data and insights.

- Visibility and data collection: Direct sales enable a clear correlation between ex-factory shipment data and retailer sell-in, ensuring that the data reflects actual sales to retailers. This transparency allows for precise tracking of volume flows and consumer data. In contrast, when working with a distributor who supplies multiple retailers, this level of visibility may not be available, and there’s often no transparent relationship between sell-in and sell-out.

- Clear ROI and profitability: Direct distribution channels often have higher margins due to the absence of intermediaries. However, this is not a hard and fast rule. The profitability of direct versus indirect retailer sales can vary based on the price/pack strategy. For instance, selling a multipack directly to supermarkets might yield a certain profit margin, but selling single consumption packages through an intermediary to convenience stores could potentially offer a higher profit per item for the manufacturer. The key is to focus on clear ROI, investing in partners that can provide immediate uplift through promotions or payback through true collaboration.

Cons:

- Higher costs: Direct sales can incur higher costs, especially for developing, training, and managing a sales team. There may also be higher costs for products requiring specialized shipping, such as chilled or frozen items, or for deliveries to small-scale outlets with low volume.

- Scaling: Entry in new markets may be slower as you will need to negotiate with multiple retail banners individually.

As the CPG industry continues to evolve, understanding and perfecting direct distribution channels will be increasingly important for companies looking to thrive in a competitive market.

Indirect route to market: the intermediary approach in CPG

Indirect distribution channels in the CPG industry involve using intermediaries or distributors. These intermediaries facilitate the movement of goods to retailers and ultimately, to consumers. This method contrasts with direct sales, where companies sell their products without third-party involvement.

Intermediaries and distributors play a crucial role in the CPG distribution chain. They can act as the link between CPG companies and the market, handling the logistics and complexities of getting products onto store shelves and into the hands of consumers. Their expertise in distribution logistics, market knowledge, and established relationships with retailers are invaluable to CPG brands. This is especially true for CPGs lacking the scale or infrastructure to manage widespread distribution independently.

Indirect sales to retailers can happen in a few different configurations. A distributor may supply products to just one retailer (one-to-one). A single distributor may serve multiple retailers (one-to-many). A retailer may also procure goods from several distributors (many-to-one). The most intricate scenario is when multiple distributors interact with multiple retailers (many-to-many), which often complicates tracking sales volumes and prices.

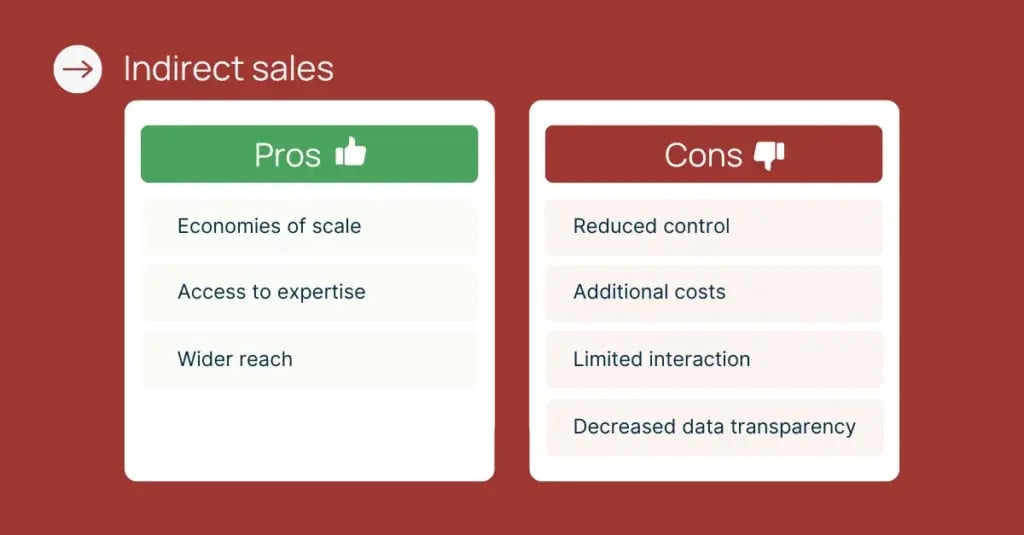

Pros and cons of indirect retailer sales

Pros:

- Economies of scale: By consolidating logistics and distribution, intermediaries can reduce costs, particularly for specialized transport, long distances, or servicing smaller retail banners.

- Access to expertise: Distributors offer specialized services and expertise that can be critical for navigating complex market dynamics.

- Wider reach: Intermediaries enable CPG companies to expand their market reach, often beyond what they could achieve on their own. They can also be part of a strategy for rapid market entry, especially in new geographies.

Cons:

- Reduced control: Once products are sold to distributors, CPG companies have less influence over how their products are managed and presented in retail environments.

- Additional costs: Distributors typically operate on margins that are a percentage of the wholesale price. This adds an additional layer of cost to the distribution process.

- Limited interaction: Indirect sales can lead to fewer opportunities for direct engagement with retailers. However, this isn’t always the case. For instance, while logistics might be managed by a third party, the commercial team of a CPG company may still interact directly with the sales account. This increases complexity, as the lack of transparency makes it more difficult to agree on dynamic fees (e.g., a growth bonus of 1% of invoice value).

- Decreased data transparency: There is less visibility into the volume flows of products, which can complicate market analysis.

In summary, while indirect sales can offer benefits like cost savings and broader reach, they also come with trade-offs such as reduced control and transparency. CPG companies must weigh these factors carefully when designing their route-to-market strategies. Additionally, they must ensure that they align with their business goals and market conditions.

Don't let complexity cloud your commercial planning. Download our complimentary guide: Indirect Routes to Market in CPG: From Obscurity to Transparency.

CPG distribution and channel strategy

In the multi-faceted world of CPG distribution, the right software supplier—one that truly grasps the nuances of the market—is invaluable. Visualfabriq stands out in this regard, crafted by industry insiders to deliver deep market-specific insights.

Data is the cornerstone of informed decision-making in distribution. It provides CPG companies the clarity and evidence needed to make strategic choices, from selecting the most effective distribution channels to adapting swiftly to market shifts. Brands can leverage data in many ways to enhance their distribution strategies. For instance, demand forecasting becomes more accurate with AI-enhanced data analytics, enabling brands to anticipate and adjust their volumes accordingly. Identifying the most effective channels also becomes data-driven, allowing brands to focus their efforts on where they yield the highest returns. Moreover, staying ahead of market trends is crucial. Data provides the foresight needed to pivot strategies in real-time, ensuring brands remain relevant and competitive.

Visualfabriq’s AI-powered revenue management software emerges as a powerful ally for CPG companies. Its capabilities extend beyond mere data analysis; it facilitates the application of insights into actionable distribution strategies. With Visualfabriq, companies can fully comprehend their market standing through a detailed analysis of data from ex-factory to sell-through to sell-out. This comprehensive view remains insightful even when certain data sources, like sell-through, are unavailable. The software’s predictive capabilities are impressive. They allow companies to not only grasp their current position but also to forecast and influence their future market path, keeping them ahead in the competitive CPG industry.

Strategizing distribution channels in CPG: 3 takeaways

What to take away from this post?

- Adaptability is key: The CPG sector must evolve its route-to-market strategies. This is vital to stay competitive in a retail landscape that is merging digital and physical shopping experiences.

- The role of intermediaries: Indirect distribution channels through intermediaries can expand market reach and reduce costs. But they may also bring challenges for CPG companies such as less control and reduced customer interaction.

- Data-driven decisions: Leveraging data and technology, like Visualfabriq software, is crucial for making informed distribution decisions and adapting to market trends.

To see Visualfabriq in action and learn how it revolutionizes the world of CPGs, booking a demo is a great next step.

.webp)